Formulary Tiers: How Insurance Decides Which Drugs Cost What

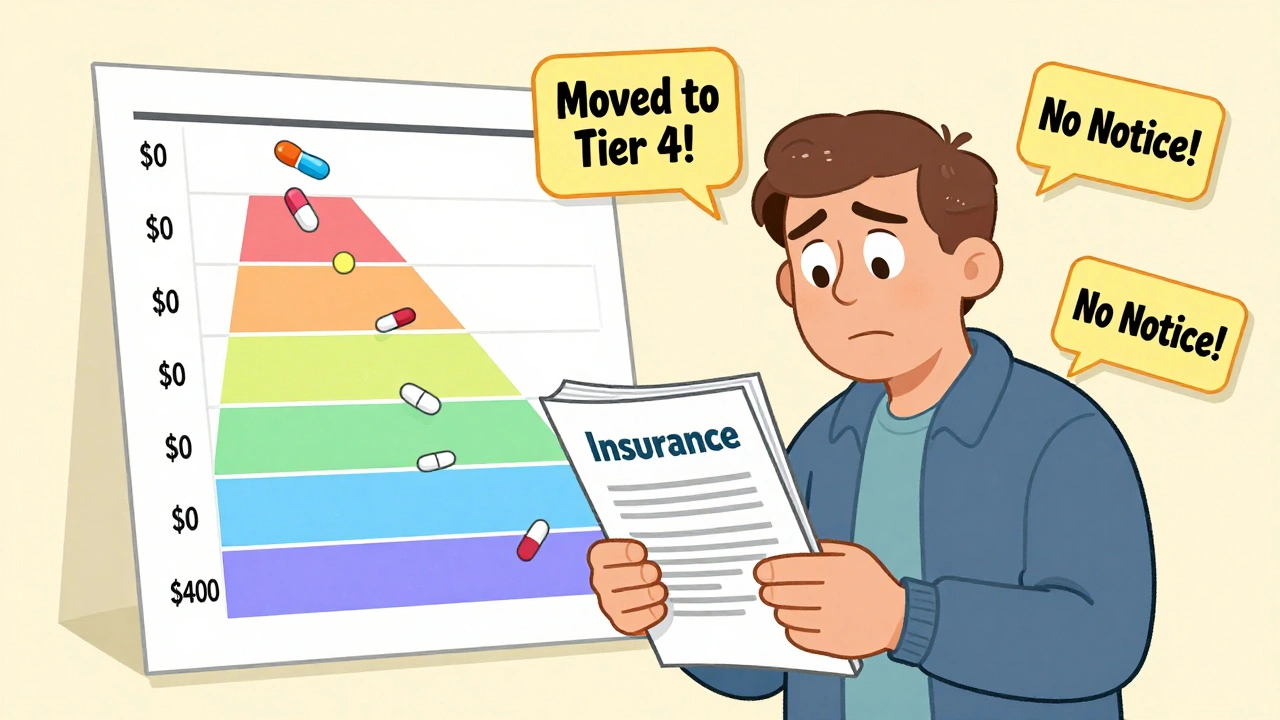

When your pharmacy says your drug is on formulary tiers, a system insurance companies use to organize medications by cost and coverage. Also known as drug tiers, it determines how much you pay out of pocket — not what your doctor thinks you need. It’s not about effectiveness. It’s about money. Insurance plans put drugs into levels — usually Tier 1, Tier 2, Tier 3, and sometimes Tier 4 or 5 — and your copay jumps with each level. The lowest tier? That’s almost always the cheapest generic. The highest? That’s the brand-name drug with no close substitute.

Behind every tier is a step therapy, a rule that forces you to try cheaper drugs first before getting the one your doctor prescribed. Also known as fail-first policy, it’s built into most formularies to save money — but it often delays treatment. If your doctor says you need a specific medication, but your plan requires you to try two generics first, you’re stuck waiting. And if those generics cause side effects or don’t work? You’ll need a prior authorization, a paperwork hurdle where your doctor proves to the insurer why the higher-tier drug is necessary. Also known as drug prior authorization, it can take days or weeks to get approved.

Why does this matter? Because generic drugs, medications with the same active ingredients as brand-name drugs but sold at lower prices. Also known as generic medication, they’re the backbone of Tier 1. But not all generics are treated the same. Some insurers restrict which generic manufacturers they cover — even if they’re chemically identical. That’s why switching from one generic to another might suddenly make your symptoms worse, or why your pharmacy might give you a different pill than last month. It’s not your body changing — it’s the formulary. And when you’re on multiple meds, like for diabetes or high blood pressure, even small changes in your formulary can mess up your whole routine. States and employers tweak these rules differently. Medicaid might push generics harder than a private employer plan. Some plans cover a brand-name drug with no step therapy at all — if you’re lucky.

You’re not powerless here. Formulary tiers aren’t set in stone. You can ask for exceptions. You can switch plans during open enrollment. You can talk to your pharmacist about cheaper alternatives on the same tier. You can even file an appeal if a drug you need is blocked. What you pay isn’t random. It’s calculated. And once you understand how formulary tiers work — who decides them, why they change, and how they connect to step therapy and prior authorization — you stop being a passive patient. You become someone who knows how to navigate the system.

Below, you’ll find real stories and practical guides from people who’ve dealt with these exact issues: why a generic made them sick, how they fought a prior authorization denial, what to do when your insurance suddenly drops a drug from coverage, and how to find out what tier your meds are on without calling customer service. These aren’t theory pieces. They’re lived experiences — the kind that help you get the right meds, at the right price, without unnecessary delays.

Insurance and Medication Changes: How to Navigate Formularies Safely in 2025

Learn how to navigate insurance formularies safely in 2025, avoid unexpected drug cost hikes, and ensure continuous access to your medications with step-by-step guidance and real-world tips.