Formulary Cost Calculator

Medication Cost Comparison

See how your medication costs change if your drug is moved to a different tier or you switch to a generic alternative.

Cost Analysis

Potential Savings

What to Do Next

What Is a Formulary-and Why Should You Care?

A formulary is your insurance company’s official list of covered prescription drugs. It tells you which medications are available under your plan, how much you’ll pay for them, and whether you need special approval to get them. This isn’t just paperwork-it directly affects whether you can afford your meds, get them on time, or face unexpected bills.

Most health plans in the U.S. use formularies. In fact, 99.7% of Medicare Part D plans and 92% of commercial plans rely on them. They’re designed to save money-for both you and the insurer-by steering you toward drugs that work just as well but cost less. For example, switching from a brand-name drug to a generic can cut your monthly cost from $120 to $10. The average Medicare beneficiary saves about $1,845 a year thanks to formulary rules.

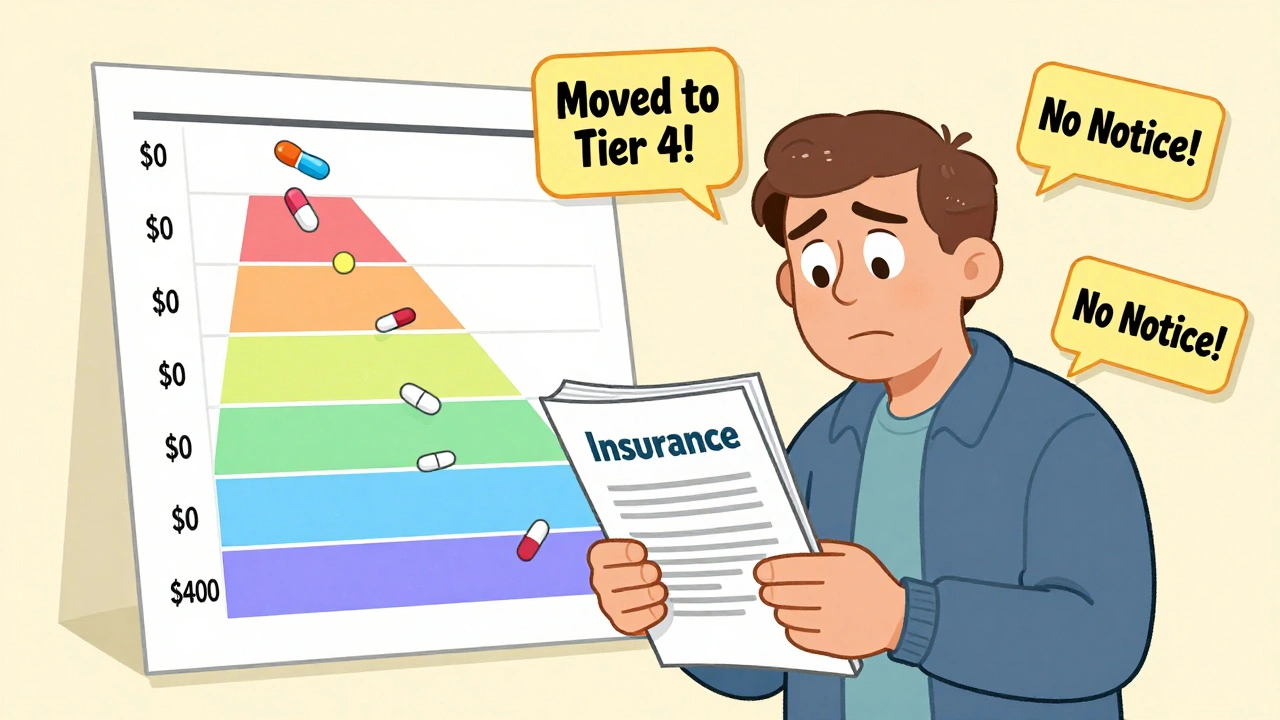

But here’s the catch: formularies change. Every year, usually on January 1, insurers update their lists. Sometimes they move a drug to a higher tier. Sometimes they drop it entirely. And if you’re not watching, you could wake up one day with a $400 co-pay for a pill you’ve taken for years.

How Formulary Tiers Work (And What They Cost You)

Most formularies use a tier system to sort drugs by cost. The lower the tier, the less you pay. Here’s how it typically breaks down:

- Tier 1 (Generic): $0-$10 copay. These are the cheapest, proven alternatives to brand-name drugs.

- Tier 2 (Preferred Brand): $25-$50. Brand-name drugs your insurer recommends because they’re cost-effective.

- Tier 3 (Non-Preferred Brand): $50-$100. Brand-name drugs with cheaper alternatives available.

- Tier 4/5 (Specialty): $100+ or a percentage of the drug’s cost. These are high-cost drugs for complex conditions like cancer, MS, or rheumatoid arthritis.

Medicare Part D plans almost always use 4 or 5 tiers. Commercial plans are more varied-68% use 3 tiers, 27% use 4, and just 5% use 5. The structure matters because moving from Tier 2 to Tier 3 can double your monthly cost overnight.

Some plans have open formularies (cover nearly everything, but at higher prices) or closed formularies (only cover specific drugs unless you get an exception). Most are partially closed-they cover a broad range but exclude certain high-cost or rarely used drugs.

When Formularies Change: What Happens and When

Changes happen every January, but they can pop up anytime. About 23% of plans make mid-year updates. If your drug is removed or moved to a higher tier, your insurer must notify you-but not always clearly.

Medicare Part D plans have stricter rules: they must give you 60 days’ notice before removing a drug, unless the FDA pulls it for safety reasons. Commercial plans only need 30 days. That might sound like plenty of time, but if you’re juggling appointments, work, or caregiving, it’s easy to miss.

In 2023, 12.7% of Medicare beneficiaries had a medication affected by a formulary change. Of those, 3.2% struggled to get an alternative. One Reddit user described how their heart medication jumped from Tier 2 to Tier 4-costing them $450 instead of $45. It took seven phone calls and three weeks to get an exception approved.

On the flip side, some transitions go smoothly. A caregiver shared how her mother’s dementia drug was replaced with a therapeutically identical one, no extra cost, no delay. The difference? Proactive planning.

How to Check Your Formulary Before It’s Too Late

Don’t wait for a letter. Don’t assume your drug is still covered. Here’s how to check your formulary in under 10 minutes:

- Find your plan name. Look at your insurance card. Write it down. Example: "Medicare Advantage Plan X by UnitedHealthcare."

- Go to your insurer’s website. Search for "formulary," "drug list," or "prescription coverage." It’s often buried under "Plan Materials" or "Member Resources."

- Search for your medication. Type in the exact name-brand and generic. Note the tier and any restrictions.

- Check the effective date. Make sure you’re looking at the current year’s formulary. Many sites still show last year’s list.

Pro tip: Bookmark the formulary page. Set a calendar reminder for October 15 each year-the start of Medicare Open Enrollment. That’s your annual chance to switch plans if your meds are no longer covered.

And here’s a reality check: 68% of Medicare beneficiaries say it’s hard to find their formulary online. If you can’t find it, call your insurer. Ask for the formulary document by name. Keep a copy.

What to Do If Your Drug Is Removed or Moved

If your medication is taken off the formulary or moved to a higher tier, you have options:

- Ask for a tier exception. Your doctor can submit a request to your insurer. Approval rates are high-78% within 72 hours-if you have documentation. Common reasons: you tried alternatives and had side effects, or the new drug won’t work for your condition.

- Request a prior authorization. Some drugs need approval before coverage. Your doctor fills out a form explaining why it’s medically necessary.

- Switch to a therapeutic equivalent. Not all drugs are the same, but many are close enough. Your pharmacist can suggest alternatives with the same effect. For example, switching from one statin to another for cholesterol.

- Appeal the decision. If your exception is denied, you can appeal. Medicare gives you 60 days to file. Use the appeal form on your insurer’s website.

Success stories show that 47% of exceptions are approved because of documented treatment failure. Another 32% are approved because of documented adverse reactions. Keep your medical records. Save your pharmacy receipts. These are your evidence.

How New Laws Are Changing the Game in 2025

The Inflation Reduction Act of 2022 is reshaping formularies. Starting in 2025, Medicare Part D will cap out-of-pocket drug costs at $2,000 per year. That means insurers can’t push you into sky-high tiers for chronic meds without limits.

Also in 2023, insulin became capped at $35 per month for Medicare beneficiaries. As a result, 94% of Part D plans removed insulin cost-sharing from their formularies entirely. That’s a win.

But there’s a darker trend: formulary restrictions are expected to rise 15-20% over the next five years as drug prices climb. The good news? Starting in 2026, Medicare will start negotiating prices for the most expensive drugs. That could lead to fewer exclusions and lower tiers.

Pharmacy benefit managers (PBMs)-companies like CVS Caremark and Express Scripts-control 87% of commercial formularies. They’re under federal scrutiny for pushing high-cost drugs into higher tiers to boost profits. A 2023 FTC lawsuit accused them of anti-competitive behavior. That could mean more transparency ahead.

What You Can Do Right Now to Stay Protected

You can’t control formulary changes-but you can control how you respond. Here’s your action plan:

- Review your formulary every October. Even if you’re happy with your plan, check your meds.

- Ask your pharmacist to flag changes. Pharmacists see formulary updates before you do. Tell them your medications and ask: "Will any of these change next year?"

- Keep a printed list of your meds. Include name, dose, why you take it, and your doctor’s name. Bring it to every appointment.

- Don’t skip refills. If your drug is removed, you’ll need time to switch. Don’t wait until your last pill is gone.

- Use the Medicare Plan Finder. It lets you compare formularies across plans. Enter your meds, and it shows which plan covers them best.

People who check their formulary before January have a 60% lower chance of a coverage gap. That’s not luck-it’s strategy.

When Formularies Work-and When They Don’t

Formularies aren’t evil. They help keep drug prices down. Studies show they reduce inappropriate use of expensive meds by 18% without hurting health outcomes. They work best for chronic conditions like high blood pressure, diabetes, or depression-where there are many equally effective options.

But they fail when there are no alternatives. For rare diseases, cancer drugs, or complex neurological conditions, formularies can create dangerous delays. One 72-year-old cancer patient went 21 days without her medication after it was removed from the formulary. No notice. No exception. Just silence.

Experts like Dr. Aaron Kesselheim from Harvard say formularies must be built on clinical evidence-not just cost. The most effective ones include input from pharmacists who see patients every day.

Bottom line: formularies are tools. They can protect you-or trap you. It depends on whether you’re paying attention.

What happens if my medication is removed from my insurance formulary?

If your drug is removed, your insurer must notify you, but you shouldn’t wait for the letter. You can request a tier exception or prior authorization through your doctor. Many requests are approved if you have medical documentation showing you tried alternatives or had side effects. You can also switch to a therapeutically equivalent drug-your pharmacist can help find one. Don’t stop taking your medication without a plan.

How often do insurance formularies change?

Most formularies update once a year, typically on January 1. But about 23% of plans make changes mid-year. Medicare Part D plans must give you 60 days’ notice before removing a drug, while commercial plans only need 30 days. Always check your formulary during Open Enrollment (October 15-December 7 for Medicare) to avoid surprises.

Can I switch insurance plans if my medication isn’t covered?

Yes. During Medicare’s Open Enrollment Period (October 15-December 7), you can switch to a different Part D or Medicare Advantage plan that covers your meds. Commercial plan members can switch during their plan’s annual renewal window. Use the Medicare Plan Finder tool to compare formularies. Make sure your drugs are on the new plan’s list before you switch.

Why is it so hard to find my formulary online?

Many insurers hide formulary documents deep in their websites, use confusing language, or show outdated lists. A 2023 Consumer Reports survey found 68% of Medicare beneficiaries struggled to find their formulary. If you can’t locate it, call your insurer and ask for the current formulary document by name. Request it in writing or email. Keep a copy.

Are generic drugs always better than brand-name drugs?

For most people, yes. Generics contain the same active ingredients as brand-name drugs and must meet FDA standards for safety and effectiveness. They’re often 80-85% cheaper. But in rare cases-like epilepsy or thyroid meds-some patients respond differently to generics. If you notice a change in how you feel after switching, tell your doctor. You may qualify for a brand-name exception.

Will the $2,000 cap on out-of-pocket drug costs in 2025 make formularies less restrictive?

It will help, but not eliminate restrictions. The $2,000 cap limits how much you pay annually, but insurers can still move drugs to higher tiers or require prior authorization. The cap protects you from extreme costs, but you may still face delays or paperwork. It’s a safety net, not a free pass. Always check your formulary even with the cap in place.

Final Thought: Stay One Step Ahead

Your medication isn’t just a pill. It’s your health, your routine, your peace of mind. Formularies are complex, but they’re not secret. The system works best when you’re informed. Check your formulary every year. Talk to your pharmacist. Keep records. Ask questions. You have more power than you think.

Michael Robinson

December 9, 2025 AT 08:49Kathy Haverly

December 10, 2025 AT 15:21Haley P Law

December 11, 2025 AT 07:14Andrea DeWinter

December 12, 2025 AT 10:56Steve Sullivan

December 12, 2025 AT 11:09George Taylor

December 14, 2025 AT 00:30ian septian

December 14, 2025 AT 04:51Chris Marel

December 14, 2025 AT 20:05Evelyn Pastrana

December 14, 2025 AT 22:34Nikhil Pattni

December 15, 2025 AT 08:21precious amzy

December 15, 2025 AT 18:12