Insurance Formulary: What It Is and How It Controls Your Medication Costs

When you pick up a prescription, the price you pay isn’t just about the drug—it’s shaped by your insurance formulary, a list of medications approved and covered by your health plan, organized by cost and clinical preference. Also known as a drug formulary, it’s the hidden rulebook that determines whether your pill is covered, partially covered, or completely out-of-pocket. This isn’t just paperwork—it’s a financial gatekeeper. Your insurer, often working with a pharmacy benefit manager, a third-party company that manages drug benefits for insurers and employers, decides which drugs make the cut based on cost, effectiveness, and negotiations with drug makers. The result? Two people with the same condition might pay wildly different amounts for the same pill, simply because of their plan’s formulary.

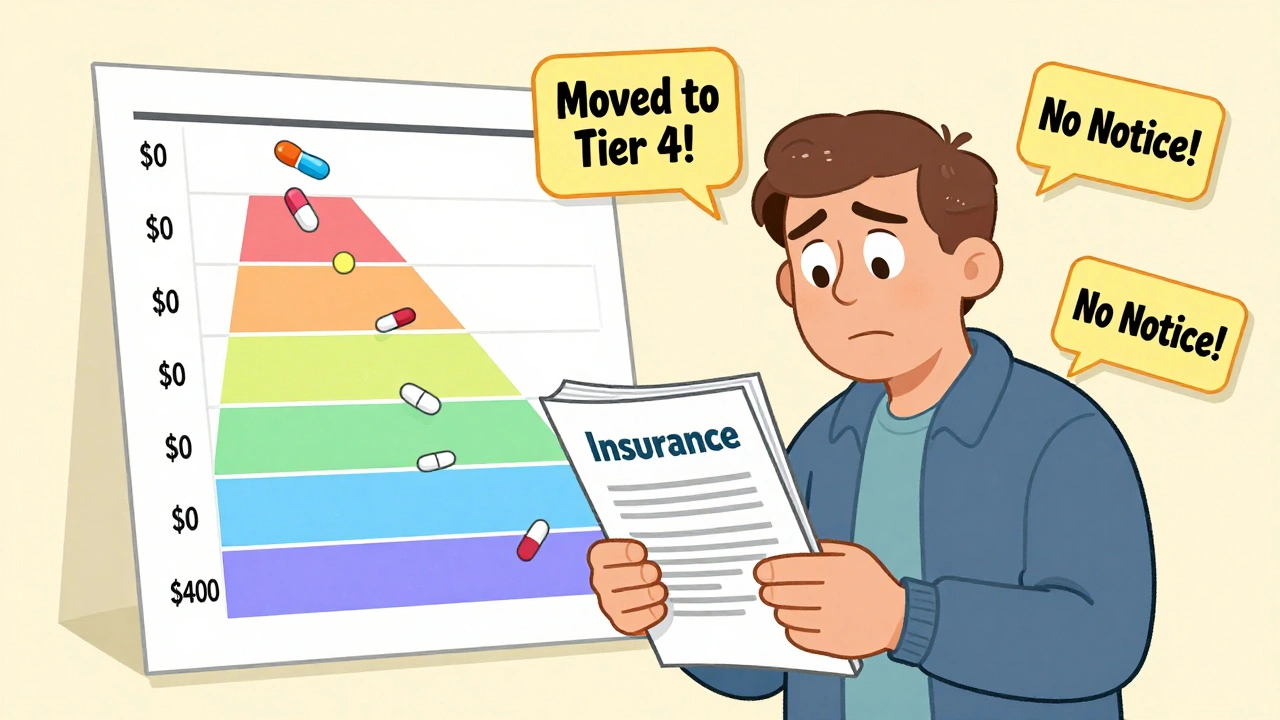

Formularies are split into formulary tiers, categories that group drugs by cost, with lower tiers meaning lower patient payments. Tier 1 usually includes generic drugs—cheapest and most preferred. Tier 2 is brand-name drugs with generic alternatives. Tier 3 and 4 are higher-cost brands, often requiring prior authorization. Tier 5? That’s for specialty drugs—like those for cancer or rheumatoid arthritis—that can cost thousands. If your drug is on a higher tier, you might pay 40% of the price instead of $10. And if it’s not on the formulary at all? You’re stuck paying full price unless you appeal.

Why do insurers do this? It’s not about being mean—it’s about controlling costs. With over 80% of prescriptions being generics, insurers push those first. But when a cheaper generic isn’t available, or your doctor insists on a specific brand, the formulary becomes a barrier. That’s why so many people end up calling their pharmacy, their doctor, or their insurer just to get a simple prescription approved. It’s not just about money—it’s about access. A drug that works perfectly for you might be blocked because it’s not on the list, even if it’s safer or better tolerated than the alternatives.

What you’ll find in the posts below are real stories and clear guides about how formularies impact real people. You’ll see how Medicaid states cut costs using generic drug lists, how drug shortages mess with formulary stability, and why switching between generics isn’t always harmless. You’ll learn how to check your formulary before filling a script, how to appeal a denial, and when a drug’s absence from the list might signal a bigger problem—like a supply chain breakdown or a price hike. This isn’t theoretical. These are the tools and insights you need to navigate your plan, protect your health, and avoid surprise bills.

Insurance and Medication Changes: How to Navigate Formularies Safely in 2025

Learn how to navigate insurance formularies safely in 2025, avoid unexpected drug cost hikes, and ensure continuous access to your medications with step-by-step guidance and real-world tips.

Generics vs Brand-Name Drugs: What Your Insurance Actually Covers

Learn how insurance plans treat generic and brand-name drugs differently, from copays and prior authorizations to state laws and patient experiences. Find out what you really pay-and how to fight for the right medication.