Drug Coverage: What Your Insurance Really Pays For and Why It Matters

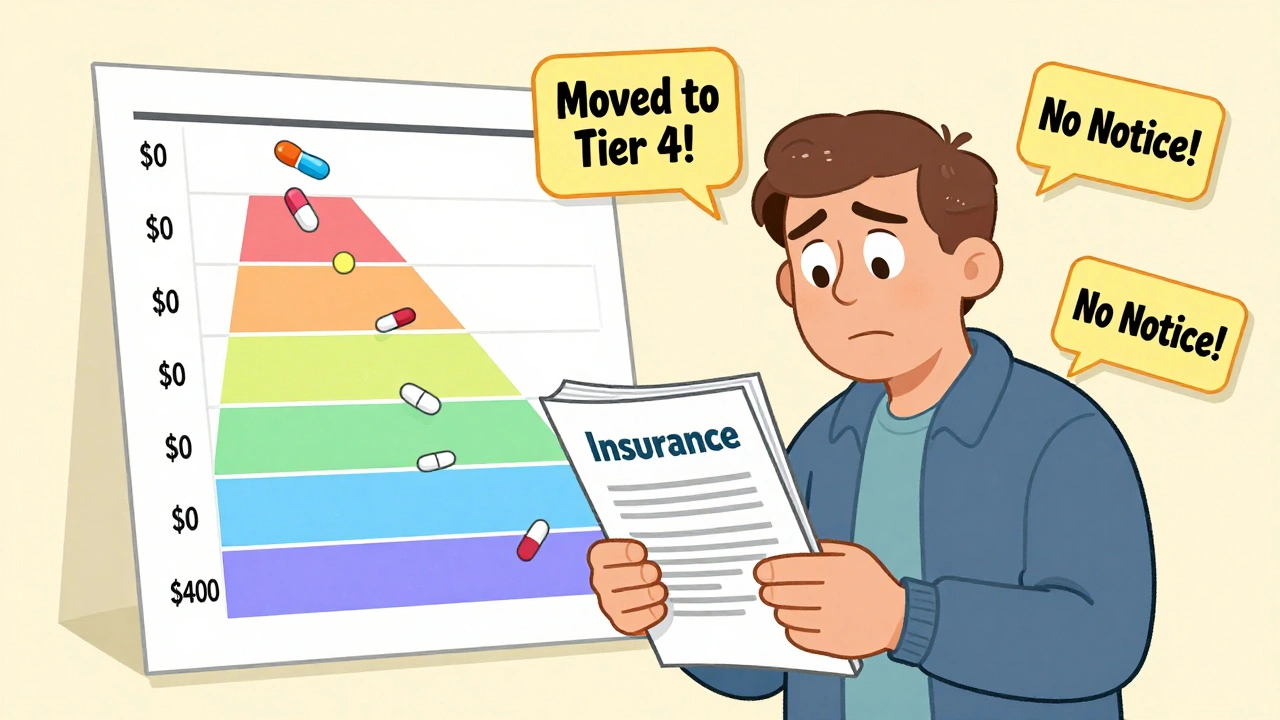

When you hear drug coverage, the set of rules your health plan uses to decide which medications it will pay for and under what conditions. Also known as pharmacy benefits, it’s not just a list—it’s a system that controls what you can get, when you can get it, and how much you pay. Most people assume if a drug is FDA-approved, their insurance will cover it. That’s not true. Insurance companies use formularies, curated lists of approved drugs that vary by plan and state to manage costs. These lists aren’t static. They change based on price, new generic versions, and even political pressure. And if your drug isn’t on the list, you might be stuck paying full price—or forced to try something cheaper first.

This is where step therapy, a policy that requires you to try lower-cost generics before getting the drug your doctor originally prescribed comes in. It’s called a "fail-first" rule, and it’s used by over 80% of private insurers. You might be on a medication that works perfectly, but if your plan requires you to try a generic version first, you could face weeks of trial, side effects, or even worsening symptoms before approval. And it’s not just about generics—prior authorization, a process where your doctor must prove to the insurer why you need a specific drug can delay treatment for days or weeks. These rules hit hardest for people with chronic conditions, rare diseases, or those on expensive biologics.

Medicaid programs across states are also reshaping Medicaid generic drugs, the bulk of prescriptions covered under public insurance. Some states now force pharmacies to dispense the cheapest generic available—even if it’s from a different manufacturer than what you’ve been using. That’s not always safe. Switching between generic versions can cause unexpected side effects, especially with drugs that have narrow therapeutic windows, like seizure meds or thyroid hormones. And when manufacturers cut corners or face supply chain issues, shortages happen. Over 60% of generic drug shortages trace back to just two countries, and when those factories slow down, your prescription vanishes.

It’s not all bad news. Many plans offer exceptions. If your doctor writes a letter explaining why a brand-name drug or specific generic is necessary, you can appeal. Some states have laws that limit step therapy for certain conditions. And with more people using tools like Medicare Part D, the federal prescription drug benefit program that sets baseline coverage rules (even if you’re not on Medicare), transparency is slowly improving. But you still need to be your own advocate. Know your plan’s formulary. Ask your pharmacist if a generic switch could affect you. Keep a list of every medication you take—and why.

Below, you’ll find real stories and practical guides on how drug coverage works in practice: how to fight a denial, why some generics cause new side effects, how Medicaid cuts costs—and who pays the price. Whether you’re managing diabetes, asthma, or just trying to afford your blood pressure pill, these posts give you the tools to understand the system—and take back control.

Insurance and Medication Changes: How to Navigate Formularies Safely in 2025

Learn how to navigate insurance formularies safely in 2025, avoid unexpected drug cost hikes, and ensure continuous access to your medications with step-by-step guidance and real-world tips.