Prescription Coverage: What Your Insurance Really Pays For

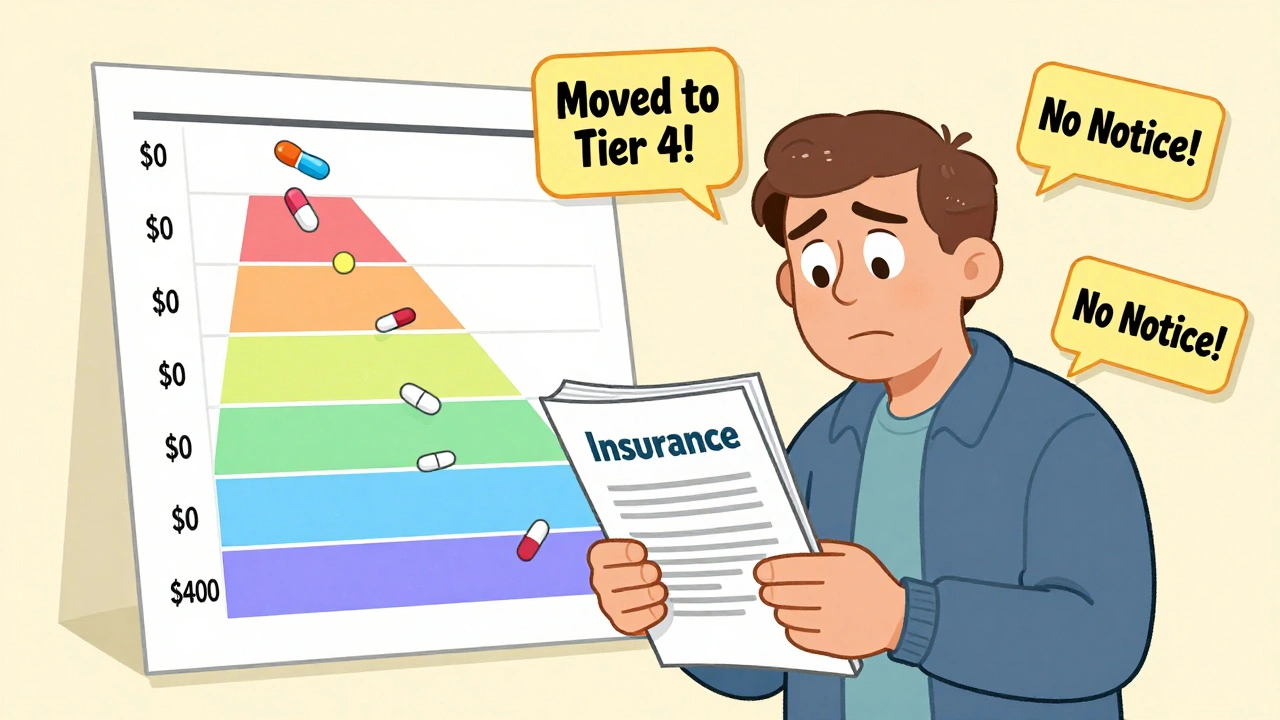

When you pick up a prescription, what you pay at the counter isn’t just about the drug—it’s shaped by prescription coverage, the rules your health plan uses to decide which drugs it pays for and how much you owe. Also known as drug formulary, it’s not a list you can easily find, but it controls everything from your copay to whether you get the medicine your doctor ordered. Most plans push you toward generic drugs, lower-cost versions of brand-name medications that are chemically identical. They’re often the first option because they save insurers money—and sometimes, they’re the only option unless you fight for an exception. But here’s the catch: just because a drug is generic doesn’t mean it’s automatically covered. Some plans require you to try one generic before approving another, or force you through prior authorization, a process where your doctor must prove the drug is medically necessary before the insurance will pay. This is called a fail-first policy, and it’s common in both private insurance and Medicaid generic drugs, state-run programs that use strict cost controls to manage millions of prescriptions.

Why does this matter? Because coverage rules vary wildly. One plan might cover a brand-name drug with a $10 copay, while another demands $75—unless you jump through hoops. Some states have laws that limit how often insurers can force you to switch generics. Others let pharmacy benefit managers (PBMs) decide without oversight. And if you’re on Medicaid, you might be stuck with drugs from a state-approved list that changes monthly. These aren’t just paperwork headaches—they affect whether you take your medicine at all. A 2023 study found that nearly 1 in 4 patients skipped doses or didn’t fill prescriptions because of coverage barriers.

What you’ll find in this collection isn’t just theory. These are real stories from people who fought their insurance, got denied for a generic they couldn’t tolerate, or discovered their brand-name drug was suddenly off-formulary. You’ll learn how step therapy works, why some generics cause side effects others don’t, and how to get exceptions when your life depends on the exact version of a drug. We’ll break down how Medicaid cuts costs—and where those cuts hurt. You’ll see how barcode scanning in pharmacies prevents errors, how drug shortages happen, and what to do when your medication disappears from the shelf. This isn’t about guessing what your insurer thinks. It’s about knowing your rights, understanding the system, and getting the treatment you need without losing money or health along the way.

Insurance and Medication Changes: How to Navigate Formularies Safely in 2025

Learn how to navigate insurance formularies safely in 2025, avoid unexpected drug cost hikes, and ensure continuous access to your medications with step-by-step guidance and real-world tips.